HOW TO RUN YOUR FIRST PAYROLL

READY TO GET STARTED?

This user guide will walk you through the process of running your first payroll and get you familiar with our platform.

LET’S GET STARTED

- Visit Simplified Payroll and Bookkeeping and select “Login” in the navigation bar on the top, right side of the screen.

- Enter your username and password under the Payroll Administration Login.

GETTING TO KNOW THE DASHBOARD

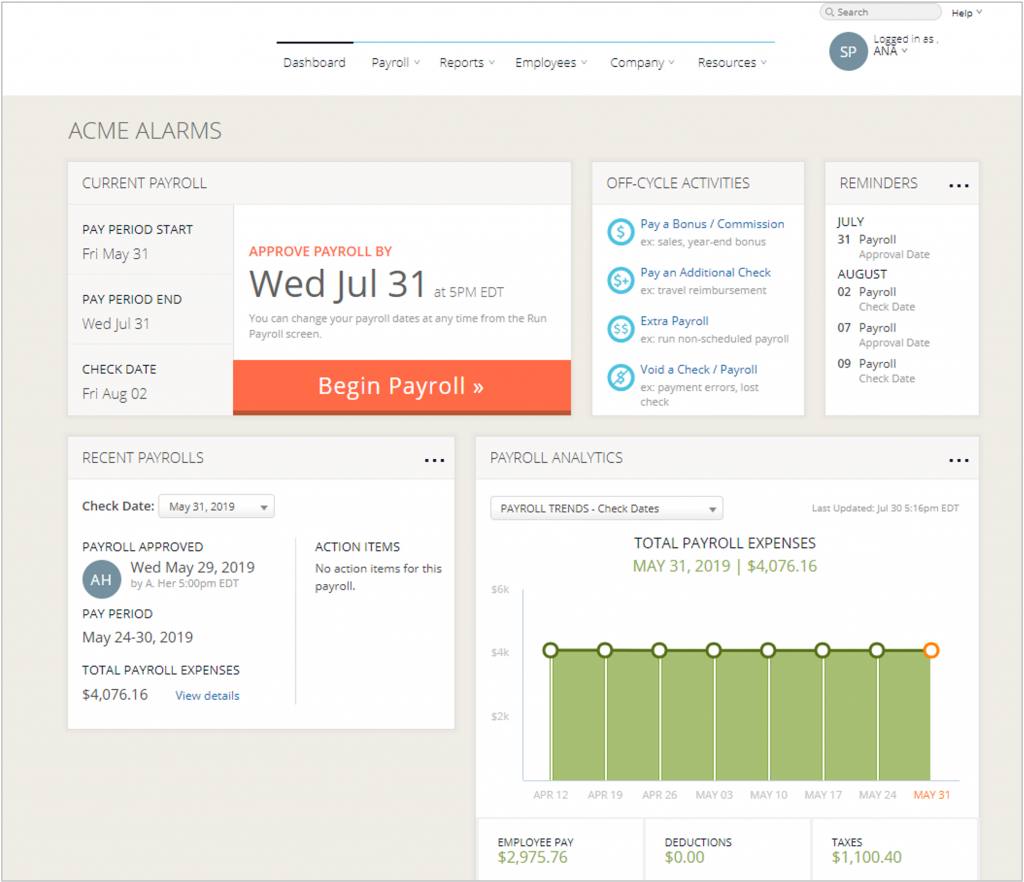

After logging in, you will be brought to your Dashboard. This is where you will start your payroll each time.

1 To get started, click the Begin Payroll button

Note: The lower half of the screen shows relevant payroll information pertaining both to recently run payrolls on our platform and key financial analytics. Click into these for a detailed breakdown.

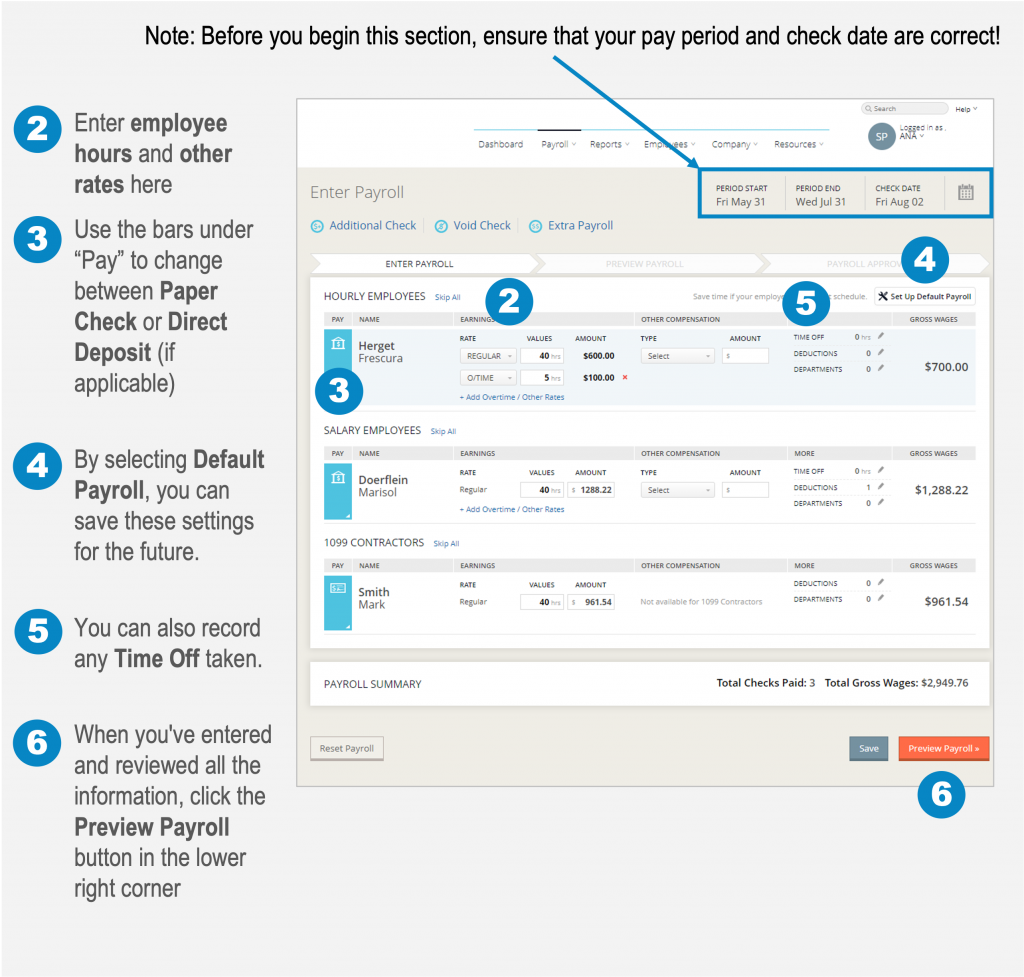

ENTER PAYROLL SCREEN

After clicking into Begin Payroll from the Dashboard, you will be taken to the Enter Payroll screen. Here you will find your employees grouped by the following pay types: Hourly, Salaried and 1099 Contractors. For Hourly Employees and Contractors, you will enter hours for each employee. Salaried Employees’ hours are auto-filled. You can enter any additional compensation, such as bonus, tips, or commission income, the employee may have earned during the pay period.

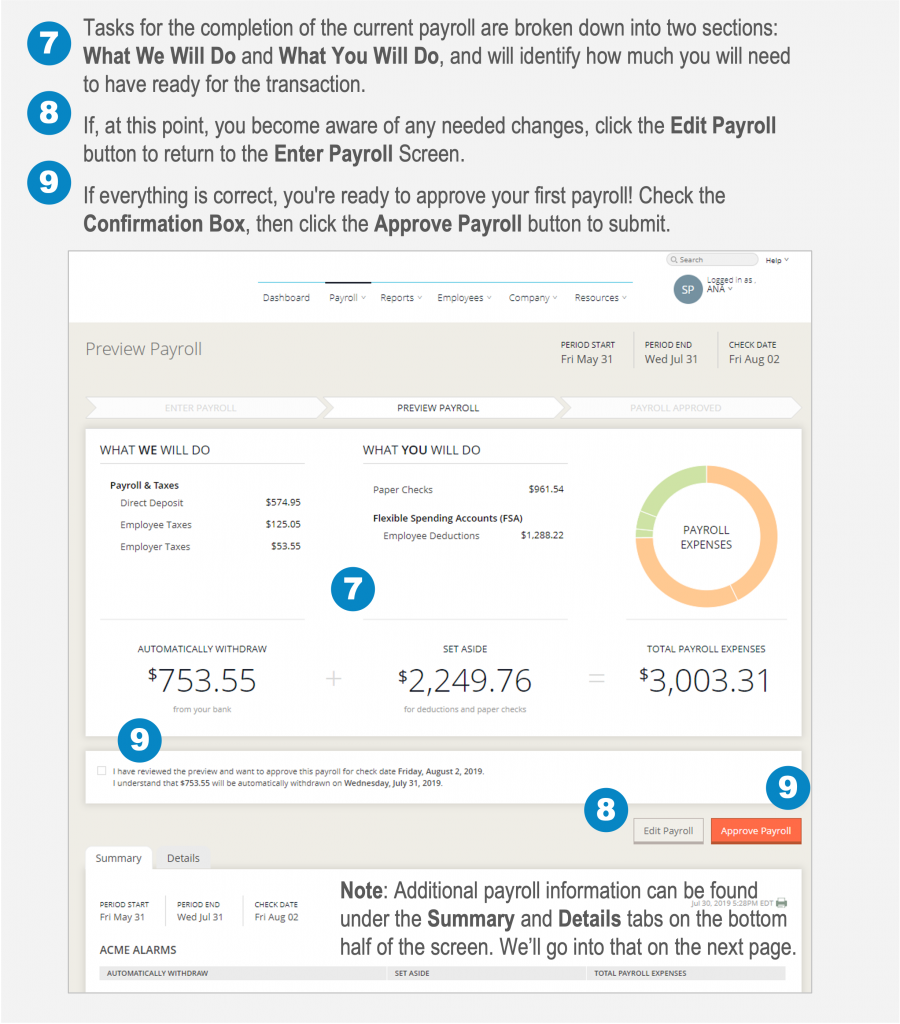

PREVIEW PAYROLL SCREEN

The Preview Payroll screen allows you a chance to review all the earnings, deductions, and taxes before approving.

PREVIEW PAYROLL SCREEN

The Preview Payroll screen allows you a chance to review all the earnings, deductions, and taxes before approving.

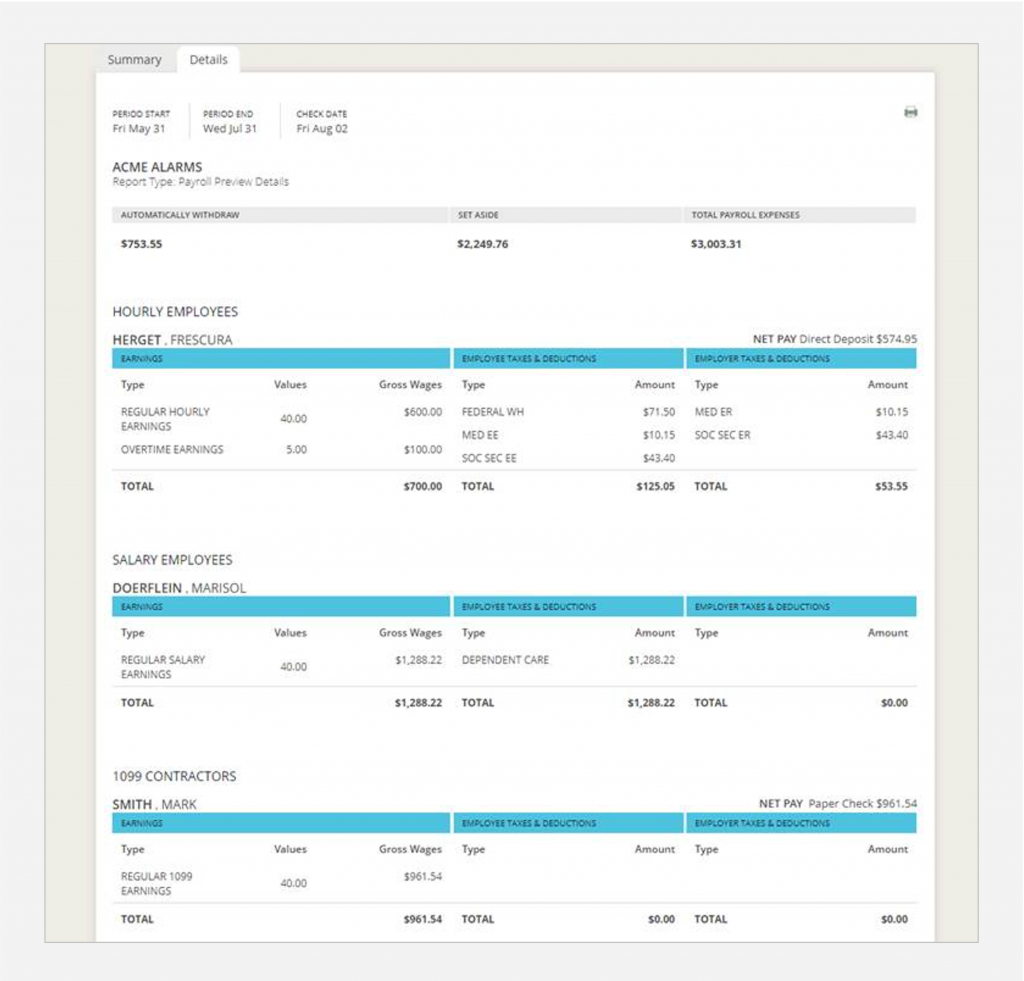

SUMMARY & DETAILS TABS

In the Details tab, you will find a more detailed breakdown of the payroll you are processing. You can see each earning, tax and deduction for each employee paid on the payroll.

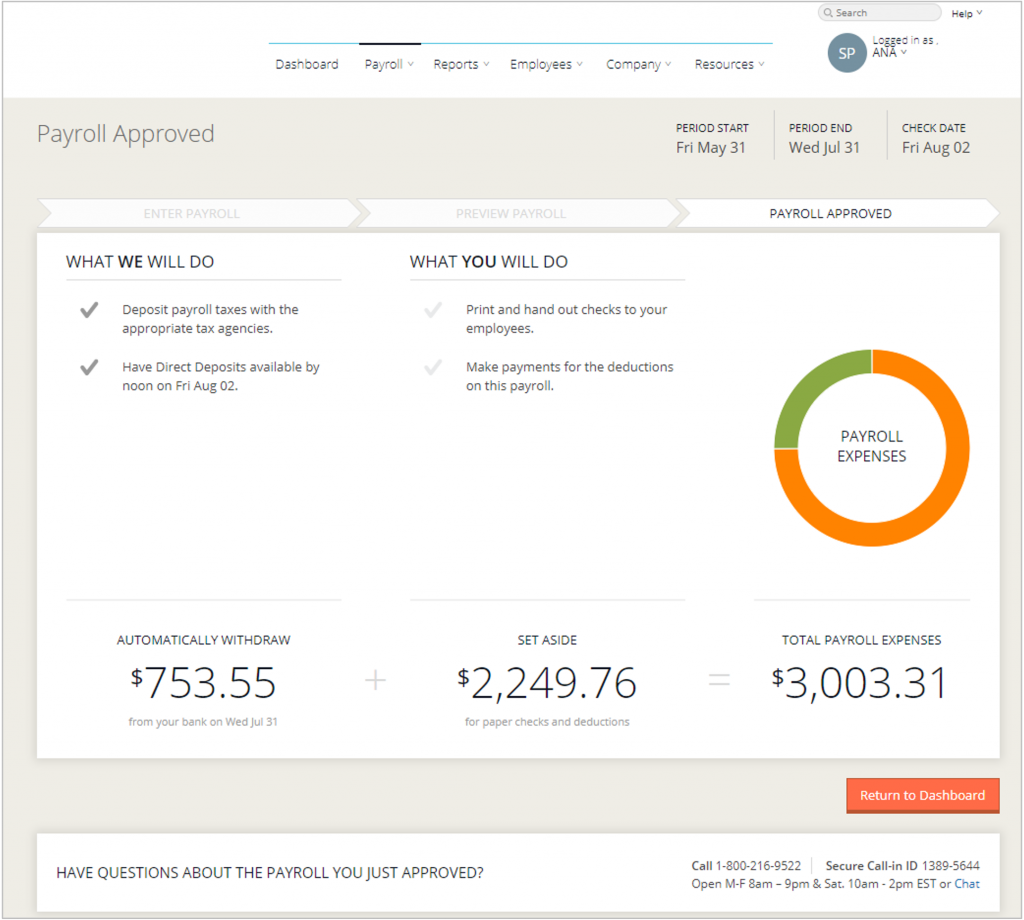

PAYROLL APPROVED SCREEN

The Payroll Approved screen gives you a confirmation that your payroll has been processed, and provides you with a reminder of What You Will Do. A confirmation email will be sent to the primary approver on file.

That’s all there is to it!! Congratulations, you have just successfully run your first payroll.

If you have any questions about the process, call 737-931-1413

Note: If you are processing payroll more than two business days before the check date, you will see a pop-up that asks if you would like to Process Early. Process Early allows the payroll to be processed and reports made available online, but your bank account will not be debited earlier than the scheduled process date nor will employees be paid earlier.

If you are located in the United States and don’t see your service area, we can still help you with your payroll and bookkeeping.

Call us at 737-931-1413 or schedule a consultation with us.