What is a 401(k) Plan?

DISCLAIMER:This article is for informational purposes only. This article is not legal advice, and you should seek professional advice. What is a 401(k) Plan? A

TAKE ACTION TODAY!

CLICK TO SCHEDULE CONSULTATION

Email: info@SimplifiedPB.com

Tel: 737-931-1413

Fax: 512-717-9517

_________________

Address:

Simplified Payroll and Bookkeeping

5401 S FM 1626 Ste 170-617

Kyle, Texas 78640

Satellite Office- By Appointment Only

8863 Anderson Mill #117

Austin, Texas 78729

The key to successful payroll processing is a successful enrollment!

We’re here to walk you through what you need to know to get your payroll setup!

If you don’t have the time, talents, or tools to handle your operation’s payroll duties, call Simplified Payroll and Bookkeeping at 737-931-1413.

Our knowledgeable team is trained to make payroll a smooth, easy, and dependable process for you and your staff so you can deal with other pressing business matters.

Let us be your resource for:

Our work is backed by 40 years of payroll management experience, and we offer a tax guarantee.

Payroll is a necessity for any business—you have to pay your employees, make the right tax deductions and then get everything paid and filed on time. This is a big task for small business owners and it isn’t how you should be spending your time.

$45Per Month

If you do Books with SPB

Plus $6 per Employee / Contractor

$60Per Month

If we do not manage Books

Plus $8 per Employee / Contractor

Leave payroll to us so you can focus on what’s most important — Your Business!

Easy three step process: Enter, Preview, Approve. Taxes are automatically paid, filed and backed by 100% tax filing guarantee.

Leading security methods and technology monitored 24/7 to keep you and your employee’s information safe.

US-based customer support team available to help you get your questions answered so you can successfully manage your business.

They receive logins to view paystubs, benefits, W2s and 1099s.

They receive logins to view paystubs, benefits, W2s and 1099s.

Ask us about 401K, Health Insurance, and Workers Compensation.

TAKE ACTION TODAY!

Email: info@SimplifiedPB.com

Tel: 737-931-1413 Fax: 512-717-9517

While it’s possible to switch payroll providers at any time, there are times throughout the year when the process is easier:

Preparing to Switch Payroll Providers

Before you make your decision to switch to a new payroll provider, there are a few basic steps you’ll want to take to be best prepared for the switch:

Review your contract with your current payroll company. Are there any restrictions that outline when you can make a change? If there’s something you don’t understand, reach out to your provider for clarification and notify them of your intent to change providers.

Sign up with your new payroll company.

Provide the new company with all the necessary information.

Officially transition everything to your new payroll company and close your previous payroll account.

Double check your new account for accuracy.

Making the Move to a New Payroll Provider

Once you’ve confidently selected a new payroll provider, it’s time to officially make the switch. The process of switching providers doesn’t have to be complicated and we are more than willing to provide a high level of assistance. This typically means completing all data entry tasks, as well as anything else required to ensure a smooth transition.

PAYROLL TRANSITION CHECKLIST:

The transition to your new payroll provider is not complete until you provide all the required information. Until you do this, your provider won’t be able to pay your employees and withhold the proper amount of taxes. Here’s a list of information your new provider will request from you:

Business Identification Numbers & Information

You should have previously collected the following information and forms from all employees:

You will need to classify workers as one of the following:

A W-2 employee

A 1099 independent contractor

Depending on state laws, you can use the same payroll schedule as before, or make a change. The most popular options are listed below but it will be important to ensure compliance with state pay frequency laws:

How will you pay your employees?

It’s Time to Run Payroll!

Once your new payroll provider has all of the required information, they can begin to run payroll on your behalf. When closing your previous payroll account, make sure you save and transfer all payroll and employee records, including:

If you switch providers in the middle of a quarter, verify with your previous provider which tax payments and filings they will be making on your behalf. They should refund you any quarterly taxes collected but not submitted to the IRS or state. They should also pay any federal and state income taxes already collected.

While it may seem like your payroll is out of sight, out of mind, you still have some responsibilities. Most importantly, you want to regularly check for accuracy regarding the following withholdings and deductions from employee paychecks:

You should also regularly review the following employer taxes:

With the help of your payroll provider, you’re also required to make the following federal and state tax deposits and filings:

Lastly, here are some of the year-end documents that come into play:

With online technology, this guide, and a payroll provider that offers transition support, it’s easier than ever to switch providers.

By choosing the right provider this time around, you can be confident in the service you’ll receive in the future.

TAKE ACTION TODAY!

Email: info@SimplifiedPB.com

Tel: 737-931-1413Fax: 512-717-9517

READY TO GET STARTED?

This user guide will walk you through the process of running your first payroll and get you familiar with our platform.

LET’S GET STARTED

Visit Simplified Payroll and Bookkeeping and select “Login” in the navigation bar on the top, right side of the screen.

Enter your username and password under the Payroll Administration Login.

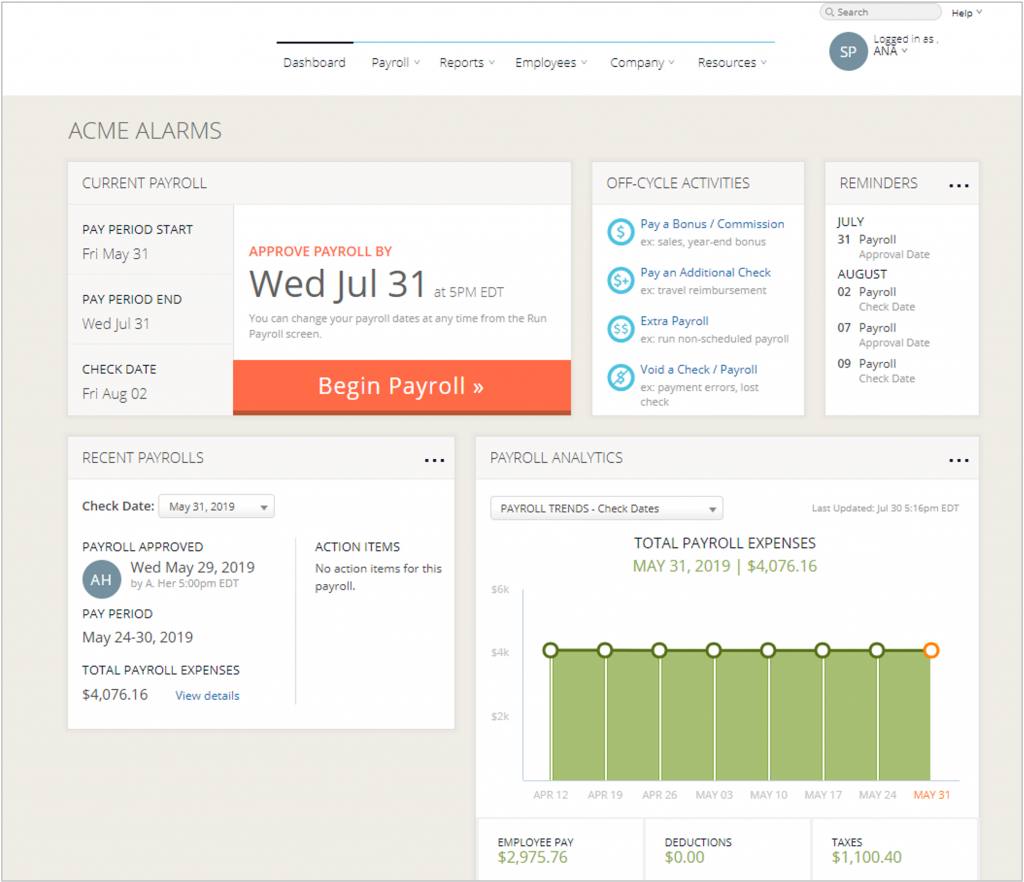

GETTING TO KNOW THE DASHBOARD

After logging in, you will be brought to your Dashboard. This is where you will start your payroll each time.

1 To get started, click the Begin Payroll button

Note: The lower half of the screen shows relevant payroll information pertaining both to recently run payrolls on our platform and key financial analytics. Click into these for a detailed breakdown.

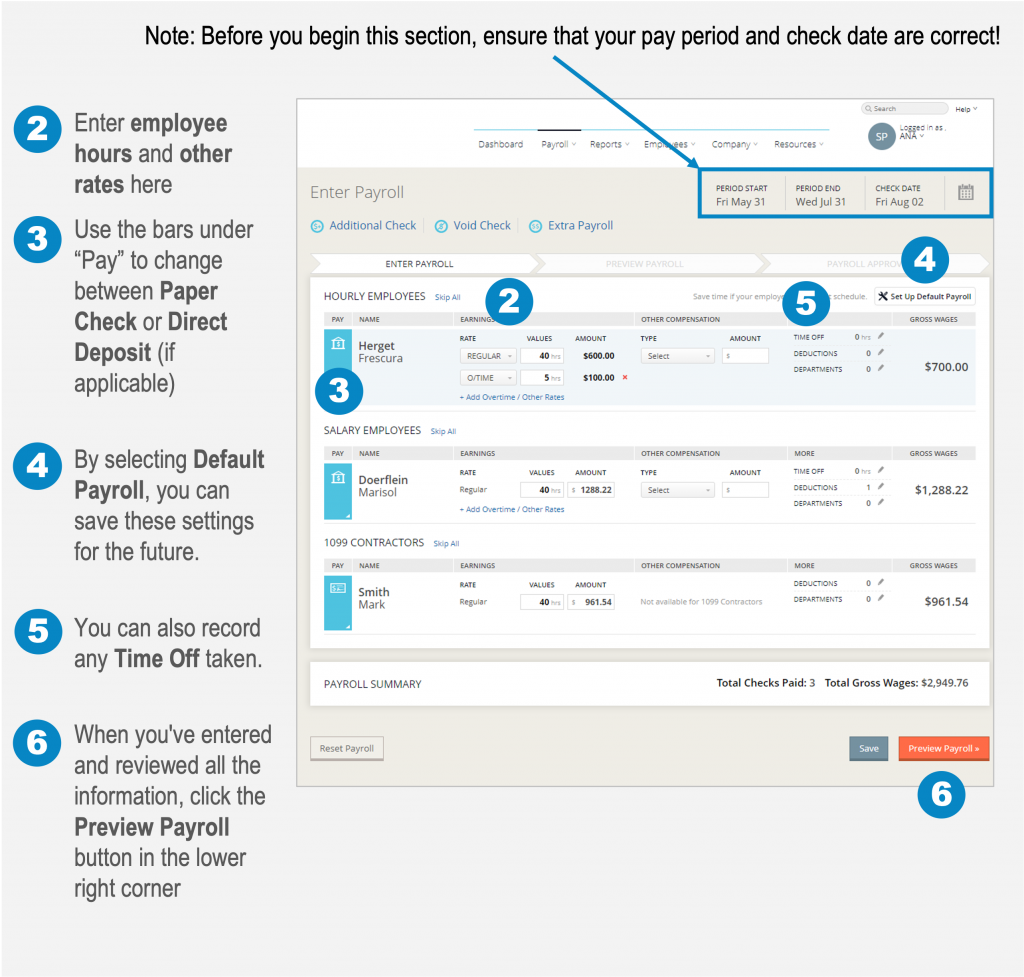

ENTER PAYROLL SCREEN

After clicking into Begin Payroll from the Dashboard, you will be taken to the Enter Payroll screen. Here you will find your employees grouped by the following pay types: Hourly, Salaried and 1099 Contractors. For Hourly Employees and Contractors, you will enter hours for each employee. Salaried Employees’ hours are auto-filled. You can enter any additional compensation, such as bonus, tips, or commission income, the employee may have earned during the pay period.

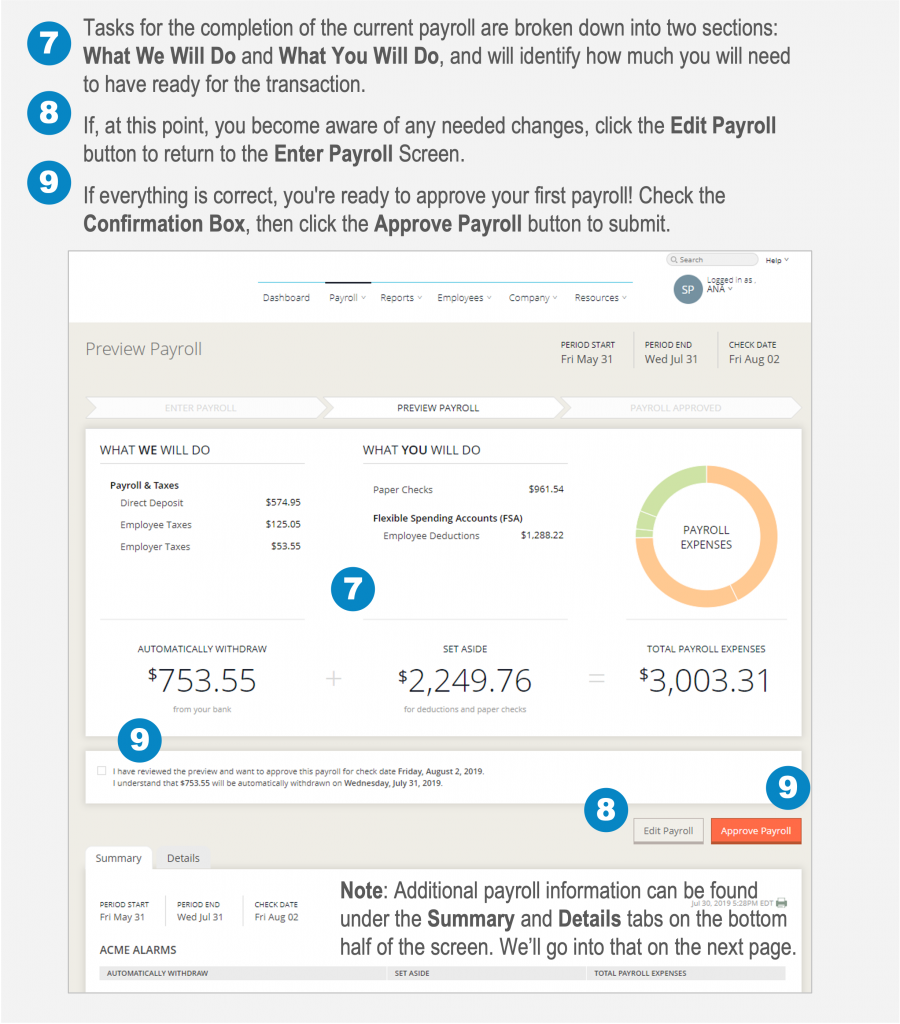

PREVIEW PAYROLL SCREEN

The Preview Payroll screen allows you a chance to review all the earnings, deductions, and taxes before approving.

PREVIEW PAYROLL SCREEN

The Preview Payroll screen allows you a chance to review all the earnings, deductions, and taxes before approving.

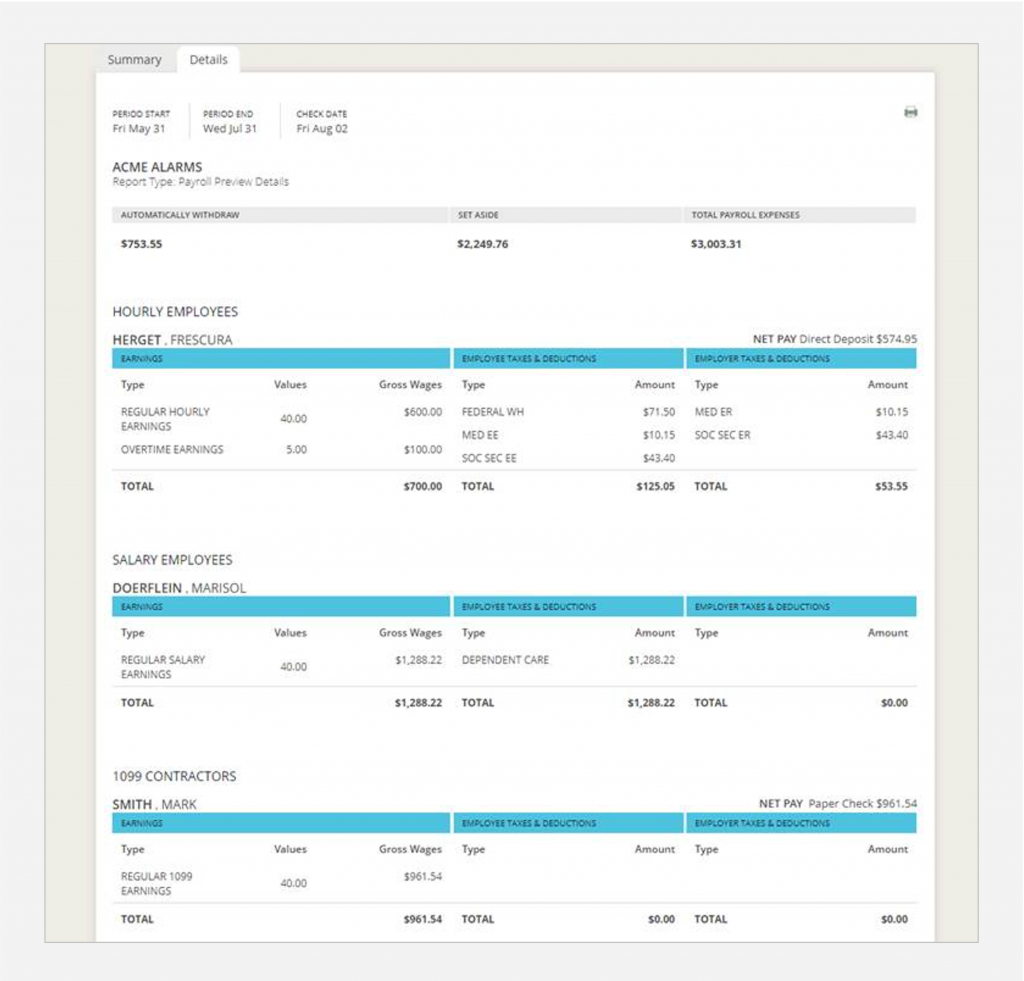

SUMMARY & DETAILS TABS

In the Details tab, you will find a more detailed breakdown of the payroll you are processing. You can see each earning, tax and deduction for each employee paid on the payroll.

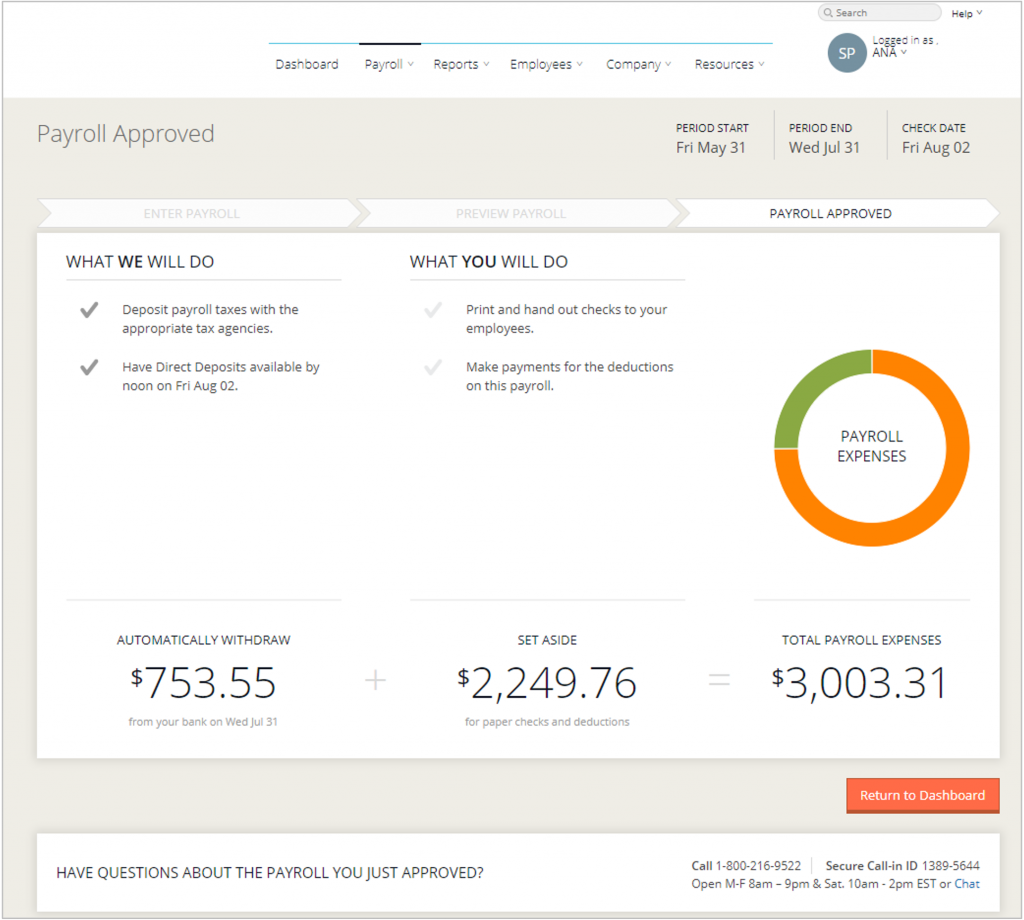

PAYROLL APPROVED SCREEN

The Payroll Approved screen gives you a confirmation that your payroll has been processed, and provides you with a reminder of What You Will Do. A confirmation email will be sent to the primary approver on file.

That’s all there is to it!! Congratulations, you have just successfully run your first payroll.

If you have any questions about the process, call 737-931-1413

Note: If you are processing payroll more than two business days before the check date, you will see a pop-up that asks if you would like to Process Early. Process Early allows the payroll to be processed and reports made available online, but your bank account will not be debited earlier than the scheduled process date nor will employees be paid earlier.

If you are located in the United States and don’t see your service area, we can still help you with your payroll and bookkeeping.

Call us at 737-931-1413 or schedule a consultation with us.

WHAT WE’LL NEED FROM YOU TO START PAYROLL:

– Their Federal Employer Identification Number (FEIN)

– The client’s bank account and routing information

– The following information for both the client and client’s employees

– PERSONAL: Name, Address, Social Security Number, and Email Address

– PAY INFORMATION, INCLUDING: Hire Date, Status Type, Pay Rates, and Deductions

– OTHER: Withholding Status and Allowances from Employees’ W-4 Forms

– BANK: Direct Deposit Information (if applicable)

A payroll is a compensation that a firm or a business usually offers employees at a certain period or a particular date of a month. Its management is done by the department of human resources or account of the firm. In most cases, the small business owners handle their payroll without any experts.

Ideally, these payrolls are mainly outsourced to certain companies that manage employee benefits, paycheck processing, accounting operations, etc. Several payroll firms include Bitwage, Wagestream, Atomic, Finch, and Pinwheel. They are working towards using better technology for more convenient payroll operations. This makes it easier and simpler to pay employees without taking much time. Moreover, it offers them any related documents needed using technology that suits their needs better.

Also, payroll is referred to as the list of employees in the company and the amount that each of them needs to be compensated at a certain period. Most businesses have this as an expense; therefore, it will be deducted from the gross income. This will lower the total taxable income of the firm. Several factors bring about the difference in payroll from time to time. This includes sick pay, overtime, and more.

DISCLAIMER:This article is for informational purposes only. This article is not legal advice, and you should seek professional advice. What is a 401(k) Plan? A

What Is the Function of Human Resources? Your people are your most valuable asset. Treating your staff fairly and offering them growth opportunities will assist

What is Payroll? Find Out with Simplified Payroll and Bookkeeping A payroll is a compensation that a firm or a business usually offers employees at

What’s the Difference Between Payroll Expense and the Cost of Labor? The cost of labor is often the most significant expense a small business incurs.